Implied Probability

Implied probability is an important concept in various market-based transactions, including the stock, option, bond, futures, currency, and swap markets. It is also a crucial concept in sports betting, whether we are looking at individual game lines, futures, propositions, and live betting markets. Keep reading to learn why implied probability is so useful in sports betting.

Bookie of the Month

Implied Probability: Simple Example

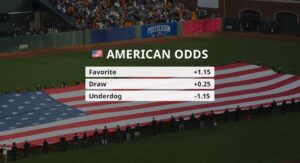

Implied probability in sports betting markets is simply a conversion of traditional odds into a percentage, but it also takes into account the house edge and eliminates it to express the odds as the ‘true odds’ of an event occurring.

Let’s take a look at a few examples of implied probability in action. We’ll start with a simple example.

What happens if we change the payouts?

Implied Probability in Sports Betting

In sports betting, the house edge, or vigorish, means that the implied probability of a set of events will always add up to over 100%. The amount over 100% is the bookie’s over round. This is their expected profit.

Let’s see an example of this in action.

On an NFL game, a sportsbook lists a game as:

- Denver -3.5 (-110)

- Oakland +3.5 (-110)

What Is the Implied Probability of Each Outcome?

We only have two possible outcomes:

- If we bet $110 on Denver -3.5, we have a possible payout of $0 for a loss or $210 for a win.

- If we bet $110 on Oakland +3.5, we have a possible payout of $0 for a loss or $210 for a win.

We take the amount we risk and divide it by the total payout to get the implied probability for each outcome:

- Denver covers: $110 / $210 = .524 or 52.4%

- Oakland covers: $110 / $210 = .524 or 52.4%

If we add these two outcomes, we get 104.8%. This means that if we bet both teams, we would need to risk $104.8 to get back $100. The bookies clearly have the edge here, in this case a 4.8% house edge for each dollar wagered.

How Do the Odds and Implied Probabilities Change for Odds Other Than -110?

The same NFL game has a moneyline of

- Denver -190

- Oakland +160

What Is the Implied Probability of Each Outcome, Ignoring Pushes?

If we ignore pushes, we only have these two possible outcomes.

- If we bet $190 on Denver, we have a possible payout of $0 for a loss or $290 for a win.

- If we bet $100 on Oakland, we have a possible payout of $0 for a loss or $260 for a win.

Again we take the amount we risk and divide it by the total payout to get the implied probability for each outcome:

- Denver wins: $190 / $290 = .655 or 65.5%

- Oakland wins: $100 / $260 = .385 or 38.5%

If we add these two outcomes, we get 104%.

Again, if we bet both teams, we automatically lose, this time $4 for every $100 wagered in the long run. This extra juice is the bookie’s edge.

Implied Probability in the Sports Betting Futures Market

Finally, let us check the implied probability for the sports betting futures market, where there are more than two possible outcomes.

For the World Cup soccer tournament, there might be a futures market listed as follows:

- Brazil +400

- Germany +800

- Argentina +900

- Italy +1050

- USA +3500

- Field +100

What is the implied probability of each team winning? Again, remember that we must divide our amount risked by the total payout to get the implied probability %.

- Brazil: 100 / 500 = .2 or 20%

- Germany: 100 / 900 = .111 or 11.11%

- Argentina: 100 / 1000 = .1 or 10%

- Italy: 100 / 1150 = .087 or 8.7%

- USA: 100 / 3600 = .028 or 2.8%

- Field: 100 / 200 = .5 or 50%

Adding all these percentages, we come up with 102.61%. The house edge in this market is actually pretty low, only 2.61%.

You can see that the field has a very high probability of winning in this case. Taking the field just means that, in this market, any team other than Brazil/Germany/Argentina/Italy/USA will win the World Cup. Based on these odds, that’s about a 50/50 chance.

Implied Probability Conclusion

Implied probability is useful in many aspects of markets, especially sports betting. If you have the listed odds, you can figure out the implied probability of an event happening. If you find a team that has a low implied probability, but you think is primed for the upset, you may have a solid bet on your hands.

However, the bookies usually don’t mind taking bets on underdogs or long shot teams, because their house edge is built in to each side, and your winnings will be paid out mostly from other bettors who laid the extra juice to play the favorite. Tread carefully but have fun!